flipkart

Xbox Game Pass April 2023 Wave Announced: Redfall, Minecraft Legends, Medieval Dynasty, and More

from Gadgets 360 https://ift.tt/E6StrLw

WhatsApp, Signal oppose UK Online Safety Bill: How India could be impacted

WhatsApp, Signal and five other apps have come together to sign an open letter to oppose Britain's Online Safety Bill. The platforms suggest that the law if regulated in the wrong way can lead to the disruption of privacy for billions of users around the globe and hence, the platforms have united to disapprove the bill.

Britain's Online Safety Bill has been primarily designed to prepare a strict set of laws for regulating social media platforms such as Facebook, Instagram, TikTok and YouTube. However, in order to regulate these platforms the fundamental aspect of privacy, end-to-end encryption is put under threat. The British government has mentioned that the bill in "no way represented a ban on end-to-end encryption, nor would it require services to weaken encryption".

Also Read: How to send original quality photos on WhatsApp on iOS, Android, and Web

However, the government wants regulator Ofcom to use accredited technology for the platforms, or advance the technology so that there can be ease of identification for child sexual abuse content.

Also read: WhatsApp users will get animated emoji feature soon, just like in Telegram

What is Encryption?The transformation of plaintext data into a non-understandable form (cipher text) where the original data cannot be recovered, which is a one-way encryption or cannot be recovered even after the use of inverse decryption technology, which is a two-way encryption.

The bill in no way provides a protection for encryption, and if implemented as written, will propagate the Ofcom to enforce the scan of private messages on end-to-end encrypted communication services. This will devoid the primary purpose of end-to-end encryption, which allows information sent through a message to be read only by the sender and recipient. This in turn will compromise the privacy agendas for the users.

Speaking of the bill and the concerns of the social platforms, a British government spokesperson said: "We support strong encryption, but this cannot come at the cost of public safety.”

Also Read: WhatsApp introduces 3 new features for security and privacy

How can this UK law impact Indian netizens?It’s not inconceivable to think that loosening WhatsApp or other private messaging apps’ encryption in Britain may impact Indian citizens interacting with their counterparts in Britain. To the best of our knowledge, India currently does not have any specific encryption laws. However, industries governing the banking, finance, and telecommunications industry verticals, mandate requirements for minimum encryption standards to be implemented in protecting financial and confidential transactions. The Central Government has the authority to frame any regime regulation of encryption under the Information Technology Act of 2000. The ITA 2000 regulates electronic and wireless modes of communication.

India governs the laws that can be aligned and be in sync with the international standards and regulations. The amendment of 2008 for ITA 2000 states that the government can prescribe the methods for encryption for electronic medium security and for e-governance and e-commerce promotion.

The private sector requires continuous adaptation and evolution of technology to provide stronger encryption on their networks to prevent any cyber security discrepancies. Taking this into consideration to combat cyber security and safeguard technology the platforms depend on a transparent national framework or regulatory presence. India has been proactively trying to mandate regulations on social media platforms which resulted in WhatsApp filing a lawsuit against them. However, the government requires a set of rules that can help the technology industry and law enforcement bodies to be able to provide better cyber security, citizen’s privacy and national security.

from Mobile Phones News https://ift.tt/0H1sT6Z

Call of Duty: Modern Warfare II Multiplayer Goes Free Through April 26 on PC, PS4, PS5, Xbox One, Xbox Series S/X

from Gadgets 360 https://ift.tt/UNGYdzn

Netflix bullishly moving forward with its password-sharing crackdown measures in Q2 2023

We were all dreading this, but it looks like Netflix is now looking at a broad rollout of its password-sharing clampdown in a few more markets. The company first introduced these measures in countries like Portugal, New Zealand, Canada and Spain and if reports are to be believed, the upper management at Netflix seems to be happy about how the launch of the service has turned out. Netflix is looking at deploying its new sharing plans in the US and other markets around the world sometime in the second quarter of 2023. As mentioned above, the streaming giant has already rolled out a ‘buy an extra member’ feature in 4 countries but is now looking at expanding that feature on a global scale.

So, how does all this really work? Let’s break it down. Say you pay for one Netflix account and have shared said account with 4 other people in your family circle. Netflix says that all 4 individuals should be in the ‘same household’ in order to access the service. What this means is that Netflix is tired of losing money on garbage TV shows and is looking at new sleazy ways of ripping off its subscriber base. Part of what made Netflix the juggernaut it now is was the ability to share your account with friends and family (legally, of course). But, in a move straight out of Scrooge McDuck’s playbook, the company is looking at wringing every drop of blood out of its customers that it possibly can. Netflix’s co-CEO Greg Peters stated that the company is looking at ‘protecting its revenue and ensuring fair usage of its service”. Well, one step towards saving revenue would be to stop producing garbage!

How this pans out for the streaming giant is yet to be seen, and on a personal note, I have family on my account who do not live in the country. So, it’ll be interesting to see exactly how this turns out in a country like India. The streaming service is already the most expensive in the country and it’ll be difficult for someone to justify an extra bit of cash for a dying service with absolutely pathetic programming.

from Entertainment News https://ift.tt/mUzRcK6

Sega to Acquire ‘Angry Birds’ Developer Rovio for $1 Billion: Report

from Gadgets 360 https://ift.tt/EFxsbRj

Philips Audio TAB8967 is the brands premium soundbar: Here are its 5 key features

Philips Audio TAB8967 has been introduced as a high-end soundbar with Dolby Atmos 5.1.2 channels. You have to splurge ₹44,990 to own this 780W audio setup. It appears to be available on Amazon India at a lower price tag though. And so, if it makes you wonder what the Philips soundbar brings in for that much money, here’s a breakdown of its specs and features.

Philips Audio TAB8967: Here’s what the soundbar has to offer

1. Philips TAB8967 is a 5.1.2CH Dolby Atmos soundbar. There are 3 front-firing speakers, 2 rear speakers, 2 up-firing speakers, and an 8-inch subwoofer, all of which in tandem offer a 360-degree surround sound effect.

2. The whole sound setup is capable of producing 780W of audio output in which the soundbar singlehandedly outs 390 watts of sound. As mentioned already, this comes backed by a subwoofer. It is compatible with Dolby Digital Plus compression technology.

3. The rear speakers are connected by a cable. They are connected to the soundbar over the air. So, most of the setup works wirelessly, and you can control the sound output using a remote. You also get Chromecast, Apple AirPlay 2, Bluetooth 5.0, dual-band WiFi ac, a 3.5mm audio jack, dual HDMI ports (with eARC), and 4K pass-through support. You can also use your voice to control the soundbar with Alexa and Google Assistant.

Mr Piush Sharma, the company chief claims their new premium soundbar “will offer consumers true surround sound experience with breathtakingly real sound flows”. He also says Philips will “continue to introduce newer and advanced innovations”.

Philips Audio TAB8967 price and availability

In India, you can buy the Philips TAB8967 soundbar at ₹44,990 through major online (like Amazon) and offline stores.

from Audio Video News https://ift.tt/FmJzL4c

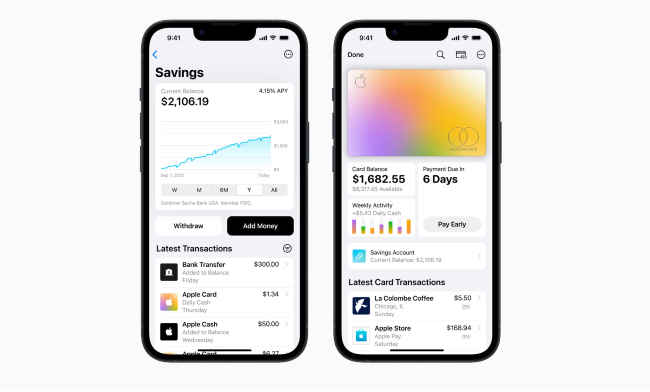

Apple Card offers a zero-balance savings account with no fees, no deposits in US: Will it come to India

Apple announced the feature of Apple Card for its US residents where users can manage and conveniently set up their Savings account directly from Apple Card in Wallet from Goldman Sachs, which offers a high-yield APY of 4.15 percent. The savings account set up requires no fees, no minimum deposits, and no minimum balance requirements.

The interface will provide users with access to a Savings dashboard in Wallet, where they can track their account balance and interest earned over time on the funds they have deposited or earned from Daily Cash with ease.

Withdrawal of funds through the Savings dashboard at any given time by transferring them to a linked bank account or to their Apple Cash card will also be easy for the users with no extra fees.

Also read: 3 Apple products expected to be announced at WWDC 23

How To Set Up A Savings Account (for US citizens only for now)You can open a savings account in less than 5 steps with the Apple Card in your Wallet App, Apple has provided a set-up guide for reference here’s how;

- Upon opening the Wallet App, tap on the Apple Card - Tap on the circle at the top of the screen with three dots - Tap Daily Cash - Select Set Up Savings.

And just like that, your account is set up.

Here all the Daily Cash that a user receives will be automated to be deposited into it and will start generating interest. Once the account is set up, users can opt to have Daily Cash added to their Apple Cash balance instead at any time. To use this feature the user should have an iPhone with iOS 16.4 or later and should be 18 years of age or older.

Also read: Tim Cook and PM Modi to meet in New Delhi to celebrate India’s first Apple Store

Once a Savings account is set up, the Daily Cash destination can also be altered at any time, and the system does not limit on how much Daily Cash users can earn. To further enhance the user experience, users can choose to deposit additional funds into their Savings account.

The funds can be deposited through a linked bank account, or from their Apple Cash balance. However, you can't make purchases or spend cash in Savings directly through your Apple Card or Apple Pay.

How To Deposit Funds In The Savings (for US citizens only for now)- Unlock your iPhone and open the Wallet app and select Apple Card. - Now select the Savings account and then tap on Add Money. - Enter the amount that you want to deposit and then tap Add. - Select or add the payment source or linked account that you want to add money from. - Double-click the side button, this will require you to confirm with Face ID, Touch ID, or your passcode.

A maximum balance of $250,000 is allowed with Apple Card Savings where the balances are insured by the FDIC. Users can transfer money to their Apple Cash balance or to a linked external bank account to access funds stored in the account. Apple says the process can take 1-3 business days to be achieved. However, there are no additional fees for withdrawals.

While this is a US-only service for now, do you think something like this will be offered by Apple in India in the near future? With Apple opening its very first retail store in the country, and Tim Cook bullish on Apple India, it looks like Apple Card and its saving related features may debut in India after all.

from Audio Video News https://ift.tt/XcP8oC0

flipkart

Edit videos on your mobile phone using the YouTube Create App

YouTube has introduced its new mobile app called ‘YouTube Create’. This app offers an easy way for creators to edit their videos right from ...

- September 2023 (83)

- August 2023 (126)

- July 2023 (113)

- June 2023 (102)

- May 2023 (162)

- April 2023 (160)

- March 2023 (148)

- February 2023 (136)

- January 2023 (173)

- December 2022 (163)

- November 2022 (163)

- October 2022 (181)

- September 2022 (178)

- August 2022 (174)

- July 2022 (136)

- June 2022 (125)

- May 2022 (146)

- April 2022 (130)

- March 2022 (143)

- February 2022 (132)

- January 2022 (145)

- December 2021 (157)

- November 2021 (239)

- October 2021 (269)

- September 2021 (270)

- August 2021 (212)

- July 2021 (252)

- June 2021 (225)

- May 2021 (184)

- April 2021 (181)

- March 2021 (343)

- February 2021 (299)

- January 2021 (320)

- December 2020 (334)

- November 2020 (305)

- October 2020 (318)

- September 2020 (340)

- August 2020 (347)

- July 2020 (337)

- June 2020 (310)

- May 2020 (308)

- April 2020 (418)

- March 2020 (316)

- February 2020 (282)

- January 2020 (329)

- December 2019 (323)

- November 2019 (393)

- October 2019 (403)

- September 2019 (386)

- August 2019 (454)

- July 2019 (579)

- June 2019 (509)

- May 2019 (697)

- April 2019 (725)

- March 2019 (746)

- February 2019 (702)

- January 2019 (932)

- December 2018 (758)

- November 2018 (729)

- October 2018 (835)

- September 2018 (838)

- August 2018 (548)

- March 2018 (24)

-

PlayStation Essential Picks and Xbox Store sales are now live. A total of over 500 games are available with up to 85 percent discounts. Game...

-

According to Nintendo, you won't need to use motion controls or physical gestures when playing Pokemon Let's Go Pikachu and Eevee in...

-

FIFA 20, Star Wars Jedi Fallen Order, Need for Speed 2019 and the rest of EA's lineup won't be on Amazon India exclusively, and will...